Commercial Banking Legal Services

Commercial Banking & Finance

Representative Experience

KJK represents a broad cross-section of commercial finance players, including financial institutions, non-bank secured creditors, and borrowers and junior lenders, whether private or institutional. We advise our clients in a variety of senior, subordinated and mezzanine debt transactions, both on a secured and unsecured basis.

We work collaboratively with other KJK attorneys in healthcare, manufacturing, tax and real estate to provide complex and sophisticated advice necessary throughout the life of a loan. And when the needs arise, our attorneys have the capability to collaboratively engage in work-out and distressed asset deals, often navigating our clients, whether lenders or borrowers, through the dual-track of work-out deals and litigation. Our attorneys are well-versed in complex debt and capital structures.

We have analyzed, negotiated and documented all aspects of finance transactions, including conduit loans (CMBS), asset-based financing, floor plan financing, structured and leveraged financing, real estate financing, multiple tranche debt, intercreditor agreements, healthcare financing, bridge loans, letter of credit facilities and rate swaps.

Lender Services

- Representing secured and unsecured convertible note holders in their investments in an early growth stage zero emission vehicle manufacturer

- Advising a senior lender in a stand-by bond purchase agreement and related unsecured revolving credit facility to finance a private higher education facility

- Negotiating complex subordination agreements and intercreditor agreements involving secured and unsecured parties in multi-tiered tranches of debt

Banking and Financial Institutions

- Advising a financial institution in an $11 million dollar credit facility to the acquirer of a manufacturer of commercial baking supplies

- Advising a national bank in a $23 million multi-credit facility provided to a manufacturer of automated packaging systems

- Representing a national banking institution in connection with a forbearance agreement, deed-in-lieu and receivership of a distressed apartment complex

Private Equity

- Representing a California-based private equity fund with the $40 million refinancing of a portfolio company, including a $17 million dividend recapitalization

Economic development

- Representing the State of Ohio in a variety of Chapter 166 economic development loans

industry-specific

- Advising a publicly held manufacturer with net sales in excess of $200 million and businesses located in the United States and abroad in connection with all of its financing needs

- Advising a leading provider of airport ground handling services to the air cargo industry in a $25 million financing

- Representing a privately held beverage distributor in negotiating for a $100 million bank financing

- Assisting medical professionals in a note participation financing transaction providing unsecured capital to facilitate the permanent refinancing of a medical building

- Counseling a national retailer of consumer fireworks in the reformation of a syndicated bank group valued at $70 million and the raising of $10 million in related mezzanine junior secured debt

- Counseling a privately held plastics company in the workout of defaults under loan agreements for $33 million of senior and subordinated debt

Total Deals Closed

Years of Experience

2019 Financing Deal Flow

Commercial Banking & Finance

Read Our Blog

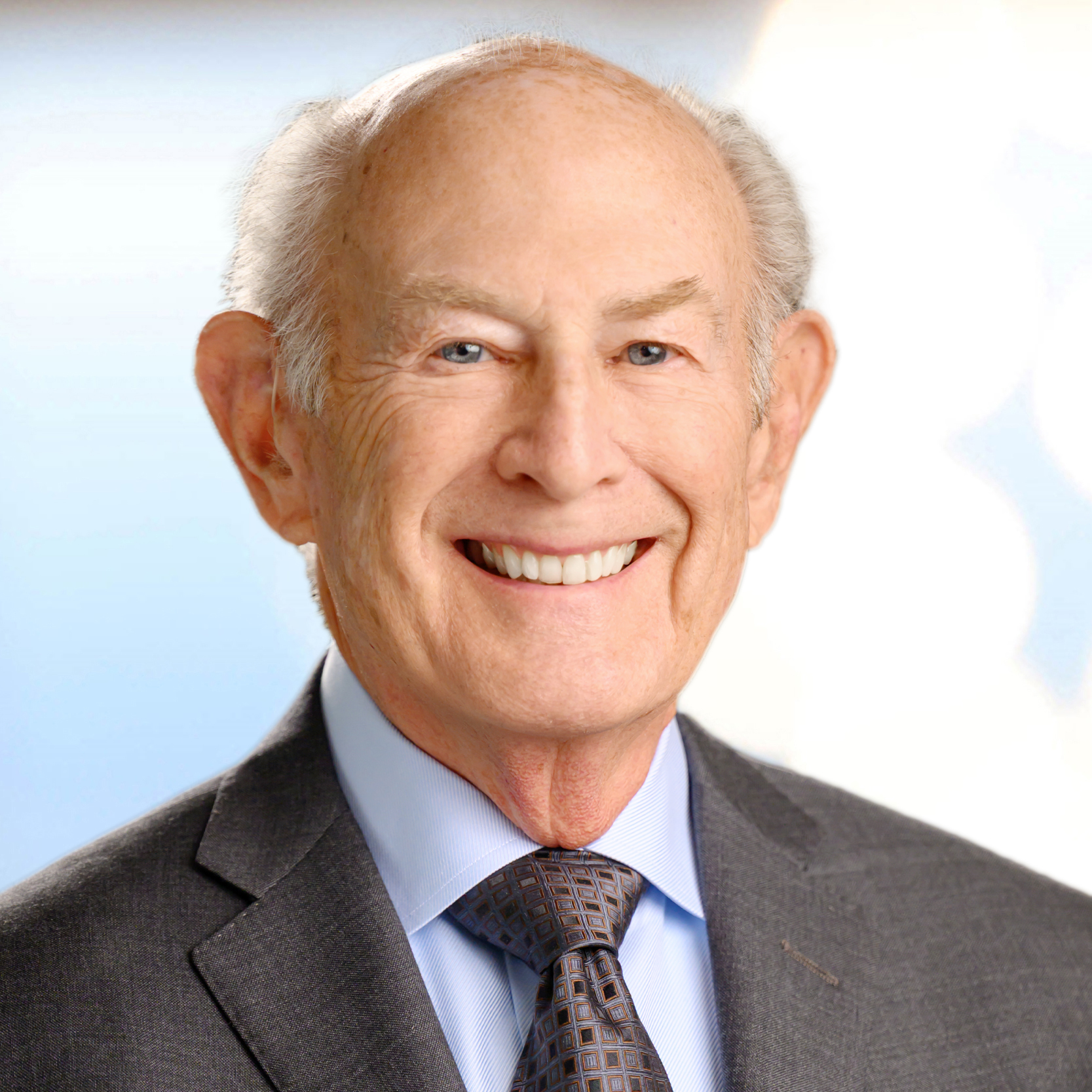

KJK’s Jon Pinney Discusses Cleveland’s Future at Destination Cleveland’s Annual Meeting

Destination Cleveland, the city’s non-profit convention and visitor’s bureau, held its annual meeting on Tuesday, August 10th, 2021 at the Cleveland Zoo. There, community stakeholders and guests listened to a presentation by Destination Cleveland President David...

CDC Reinstates Indoor Mask Policy

On July 27, 2021, the Centers for Disease Control and Prevention (CDC) once again recommended that even fully vaccinated individuals should wear masks indoors in areas with high rates of COVID-19 transmission. This reversal from its May 2021 guidance, which dropped...

SBA Makes Beneficial Changes to the Paycheck Protection Program

This week, the Small Business Administration announced the launch of a streamlined application portal for Paycheck Protection Program (PPP) borrowers who received less than $150,000 of funding. Under the new program, borrowers who received funding of less than...

Commercial Banking & Finance

ATTORNEYS

Practice Group Chair: Anne Corrigan

Contact

CLEVELAND OFFICE

1375 East Ninth Street

One Cleveland Center, 29th Floor

Cleveland, OH 44114-1793

COLUMBUS OFFICE

10 West Broad Street

One Columbus Center, Suite 2500

Columbus, OH 43215