Why the 2026 Redesignation Matters

Since their enactment in 2017, Opportunity Zones have served as a significant development tool in Ohio, directing private capital into economically distressed communities through federal tax incentives. The One Big Beautiful Bill Act (OBBBA) made Opportunity Zones a permanent element of the tax code, while making several changes to their function, including the introduction of an additional incentive for rural investments. OBBBA also requires States to re-designate Opportunity Zone census tracts in 2026 and made several changes to eligibility requirements that reduce the number of eligible tracts.

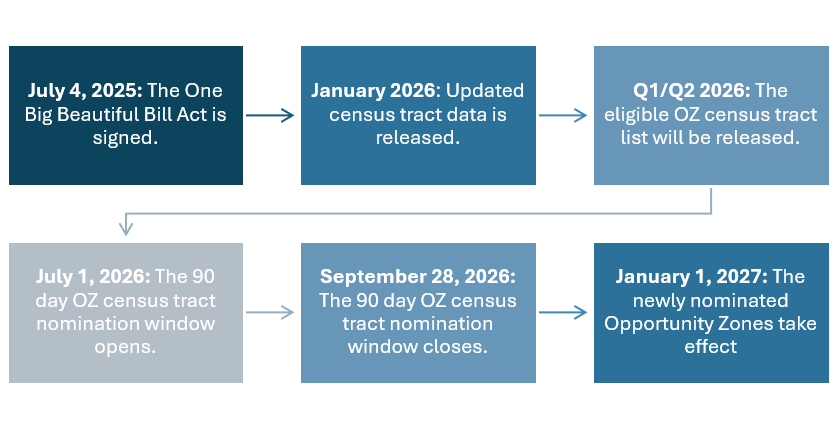

The OBBBA significantly restructures the Opportunity Zone program ahead of a new census tract designation cycle. The law ends the current Opportunity Zones at the end of 2026 and requires state governors to select a new set of zones beginning on July 1, 2026, and taking effect on January 1, 2027. After this new designation, the chosen census tracts will remain in place until 2037 when the next redesignation will occur. Each state governor may designate up to 25% of the eligible census tracts in their State as Opportunity Zones

The eligibility criteria for census tracts has been tightened by lowering the income threshold from 80% to 70% of area or statewide median income. Alternatively, a census tract qualifies if it has a poverty rate of over 20% – but the OBBBA added a restriction, disqualifying census tracts that have a Median Family Income over 125% of the statewide median income. Contiguous census tracts are no longer eligible for designation. Collectively, these changes are expected to reduce the total number of Opportunity Zone’s by roughly 20% nationwide.

For Ohio’s state and local leaders, developers, and investors, the upcoming redesignation is not procedural. It will shape where capital flows for the next decade.

Opportunity Zone Incentive Structure

Opportunity Zones (OZs) were established under the 2017 Tax Cuts and Jobs Act as a one-time federal tax policy experiment aimed at catalyzing private investment in economically distressed communities. OZs were built on the structure of similar prior programs such as New Markets Tax Credits and Empowerment Zones, with the intention of being less administratively complex and broader in scale. After the 2008 Great Recession, policymakers grew concerned about the different pace of economic recovery in prosperous communities and economically distressed rural and urban communities alike.

1. Capital Gains Deferral:

Is provided to Investors who realize a capital gain from the sale of an asset and may defer the federal capital gains tax by reinvesting that gain into a qualified opportunity fund within 180 days of the sale. The deferred gain is not eliminated but postponed until the Qualified Opportunity Fund investment is sold or exchanged or December 31, 2026.

2. Step-Up Basis:

The basis step up, or sometimes referred to as the deferred gain benefit, provides investors with a step-up in basis in the original investment. The amount is contingent on the length of time they maintain the investment in the qualifying fund. If the investment is held for five years, 10% of the original gain is eliminated. Because the deferral period ends on December 31, 2026, these basis step-ups are no longer available for new investments, but they remain relevant for legacy investments that met the holding period requirements.

3. Ten-Year Exclusion:

Arguably the most powerful opportunity zone incentive is the 10-year exclusion. If an investor holds a Qualified Opportunity Fund investment for at least ten years, any post-investment appreciation in the Opportunity Zone investment can be permanently excluded from federal capital gains tax. Upon exit, the investor may elect to step up the basis of the Qualified Opportunity Fund investment to its fair market value, effectively eliminating tax on all appreciation generated within the Opportunity Zone.

Opportunity Zone Investments Require Market Returns

In order for projects to be attractive to Opportunity Zone investors, they must be attractive market-driven investments. This seems intuitive, but is not typical – other development tax credits are triggered by the investment itself and the future success or failure of the project does not impact the value to the investor. For an Opportunity Zone investor, the tax deferral means little if there is no return on the investment and the step-up in basis has value only if the basis increases significantly.

Therefore, potential Opportunity Zone investors will thoroughly examine the potential project and compare the anticipated returns and value of the incentive to other market investment opportunities. While many Opportunity Zone investments are from the project sponsor itself, unaffiliated investors can seek investments across regions and pursue investment opportunities and returns in high-return markets.

This market-driven structure explains why investment has concentrated in certain census tracts and bypassed others, even when both were designated.

How OBBBA Restructures Opportunity Zones

The One Big Beautiful Bill Act that President Trump signed into law back in July of 2025 has changed the program and made the tax incentive permanent.

First, the bill ends all existing Opportunity Zones at the end of 2026 and establishes a new set of Opportunity Zones effective January 1, 2027. Tax benefits after 2026, including the capital gains deferral, will now only apply to investments made in the newly designated zones.

Second, the bill tightens eligibility standards, reducing the income threshold for a qualifying “low-income community” from 80% to 70% of area or statewide median income. The bill is also eliminating the ability to designate contiguous census tracts that are not themselves low income. Collectively, these changes are expected to result in approximately 20% fewer OZs nationwide.

Third, the legislation reorients incentives toward rural investment. Investors in qualifying rural OZs who hold investments for at least five years would be eligible for up to a 30% reduction in deferred capital gains taxes, compared with a maximum 10% reduction in non-rural OZs. The original 15% basis step-up is eliminated entirely. As under current law, capital gains on OZ investments held for at least 10 years remain fully excluded.

Fourth, the bill introduces robust federal reporting and evaluation requirements. Beginning immediately, the Treasury Department must annually report OZ investment levels, geographic distribution of capital, employment impacts, and housing production by census tract. Starting in 2031, Treasury must also report on measured economic outcomes, including job creation, poverty reduction, and new business formation, addressing a long-standing transparency gap in the program.

Part II: Approach To Opportunity Zone Re-Designation

In 2026, governors will be required to redesignate census tracts as Opportunity Zones. As a result of the change in eligibility, the amount of eligible census tracts has been reduced by approximately 20%.

The past decade of investment offers guidance to inform the designation decisions.

Ohio Is Uniquely Positioned to Make Impactful Opportunity Zone Designations

In 2018, Ohio’s governor John Kasich and the U.S. Treasury designated 320 Ohio census tracts as Opportunity Zones. These designations were intended to strategically channel private capital into economically distressed areas across struggling areas of Ohio. In 2019, Ohio adopted an Opportunity Zone program that paired a state income tax credit with the Federal tax benefits. Unique among states, this program requires project specific reporting for Opportunity Zone investments. As a result, Ohio governors can make informed choices on which tracts are best-suited to designate based on previous market performance of census tracts and projects that have drawn investment.

The Urban Institute has analyzed Ohio’s Opportunity Zone investments to date. Between 2020 and 2024, a total of 153 census tracts in Ohio received some level of Opportunity Zone investment. Of these invested tracts, 71 percent were officially designated Opportunity Zones, while 29 percent were non-designated tracts that nonetheless benefited from tax-advantaged capital. Most notably, investment activity was highly concentrated among a relatively small subset of designated zones. Only 33 percent of Ohio’s originally designated Opportunity Zones received any investment during the 2020 to 2024 period.

Cleveland and Columbus

Cleveland and Columbus have been the center of Opportunity Zone investments in Ohio. Cleveland has several high-value Opportunity Zones and has been recognized nationally for its efforts in converting low-value vacant buildings into high-value apartments, using complex layers of financing and construction. Greater Cleveland has received about a quarter of the total awards, but nearly half of the total dollars awarded. Opportunity Zone investments in Cleveland have been focused on larger real estate projects in a few higher-growth neighborhoods. The Columbus region has seen the opposite, with nearly half of the total awards at 40% of the total dollars. This reflects a stronger real estate market with more investment opportunities and less need for large subsidy.

Lessons from the 2017 Designations Process

After the passage of the Tax Cuts & Jobs Act created the Opportunity Zones program in 2017, states and communities scrambled to understand the program and make Census Tracts designations by the statutory deadlines.

In Cleveland, a group of leading community stakeholders came together to make consensus recommendations to the Governor of census tracts that would have the strongest potential for development. At the time, I was serving as the Director of Economic Development for the City of Cleveland. In collaboration with Cuyahoga County, Greater Cleveland Partnership, and the Fund for Our Economic Future, we focused on areas near investment or areas where infrastructure improvements were underway. We worked with other community stakeholders, developers, and finance partners to come up with development pipelines and align them with community and economic development plans to build a succinct case for census tracts. As a result, Greater Cleveland received slightly more than 30% of its census tracts designated.

The results speak for themselves. Greater Cleveland received almost half of the Opportunity Zone Tax Credit awards statewide. This shows that a thoughtful approach focused on attractive investment opportunities, backed by community buy-in, can form the type of attractive public-private partnerships that drive capital.

Strategic Considerations for 2026 Redesignation

Approximately 20% of eligible census tracts in Ohio are no longer eligible under the change in law. Dozens of current Opportunity Zones will not be eligible for designation under the new law. These tracts are most likely the most favorable market tracts – higher-income, lower-poverty, and adjacent tracts.

In Cleveland, high-investment tracts on the Downtown Lakefront and the near west side will no longer be eligible. Accordingly, strategic thought will be required to maximize investment opportunities and impact economic development. Parts of downtown and the near west side that have drawn for Opportunity Zone investment will no longer be eligible. However, there are still other neighboring tracts, including parts of the east side of downtown, and neighborhoods in the west side where development opportunities exist and will continue to grow as existing projects come to fruition. Recent infrastructure expansions like the Opportunity Corridor and the pending investments along Superior and Lorain Avenues may lead to investment and growth opportunities in the coming years.

The push for rural development could be a boon to small towns and micropolitan areas. Small cities and towns that have a critical development site or main street should start focusing on positioning those projects for investment. It will likely remain difficult to attract investor funds to isolated areas due to the structure of the OZ incentive, but those areas should examine whether there are specific investment opportunities in the energy or data sector that may be less location-dependent. Communities may also want to look at these opportunities for other state resources, such as TMUD or brownfield incentives, as well as deploying local development tools, to stimulate investment opportunities in 2027.

Lessons Learned for Opportunity Zones 2.0

For the State: Governors should seek input from their local communities and partners. Local market trends are the most important factor in determining whether a census tract is a draw for Opportunity Zone investment. Governors should also factor in project pipelines to ensure that there are shovel-ready investment and development opportunities to take advantage of the Opportunity Zone designation and continue to grow market investments. Governors should also coordinate with their Departments of Transportation to identify key infrastructure investments – both those that are underway and will open up new development opportunities, and infrastructure in the pipeline that can be expedited in order to maximize the Opportunity Zone.

For Local Communities and Stakeholders: Local communities should be collaborating with their private development interests to identify a pipeline of projects, especially those that will need Opportunity Zone and other incentives to move forward. They should be examining their own community development strategies and plans as well as their future capital and infrastructure investments to determine emerging development opportunities. As they do so, they should start building their justifications for attractive census tracts to designate and examine how they can work together toward future growth. They can nominate tracts within the 90-day designation period starting July 1, 2026, with OZ 2.0 taking effect on Jan 1, 2027.

For Developers and Practitioners: Developers and practitioners should be examining their projects and ensuring that they are in contact with local and state stakeholders. They should understand how their projects fit together with other projects and community plans to further take advantage of Opportunity Zone investment and support community initiatives. They should be building the case that Opportunity Zone designation is critical to their investment and financing strategy, and be able to show governments and stakeholders how the OZ designation impacts the project in scope, scale, and feasibility.

The Opportunity Zone Window Is Strategic, Not Automatic

The 2026 redesignation cycle presents a meaningful opportunity for Ohio to recalibrate where long-term private capital flows. Thoughtful coordination among state leaders, local communities, developers, and investors will determine whether Opportunity Zones 2.0 expands market momentum or leaves capital on the sidelines.

KJK’s Economic Development Team is here to help position projects for Opportunity Zone investments now and in the future. Reach out to our team to help position a project for investment, attract state and local incentives for development, or help your community approach its investment decisions. To discuss further, please contact KJK’s Director of Economic Development & Incentives, David Ebersole at DME@kjk.com.